The December 2024 WSTS forecast called for strong 2024 semiconductor market growth of 19%. However, the strength is limited to a few product lines. Memory is projected to grow 81% in 2024. Logic is expected to grow 16.9%. The micro product line should show only 3.9% growth, while discretes, optoelectronics, sensors and analog are all projected to decline. If the memory product line is excluded, the WSTS forecast for the rest of the semiconductor market in 2024 is only 5.8%.

The strength of memory in 2024 is also reflected in semiconductor company revenues. Revenue for the first three quarters of 2024 compared to a year earlier show gains of 109% for both Samsung Memory and SK Hynix. Micron Technology is up 78% and Kioxia is up 54%. The strongest growth among major semiconductor companies is from Nvidia, up 135%. Nvidia strength is due to its AI processors. Nvidia’s revenues also include memory purchases, adding to its revenue.

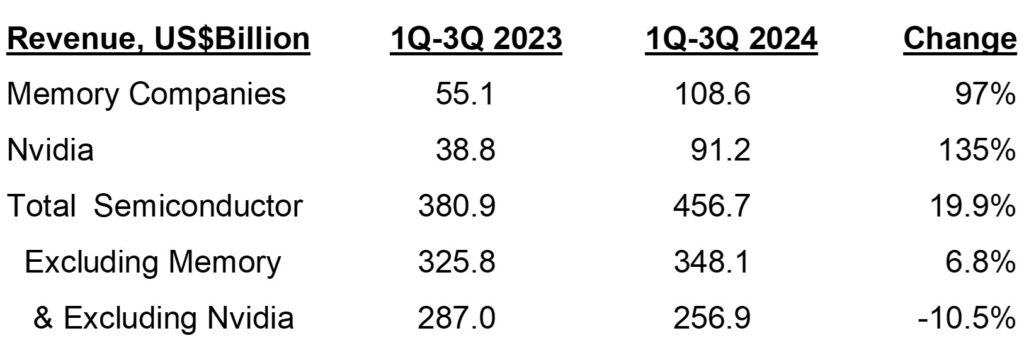

The strength of memory is largely driven by memories for AI applications. Prices for memory have increased in 2024, especially for DRAM. Trend Force estimated average DRAM prices will be up 53% in 2024. Thus, one application, AI, is accounting for most of the growth of the semiconductor market in 2024. The revenues for the first three quarters of 2024 compared to the same three quarters of 2023 show a 97% gain for memory companies and a 135% gain for Nvidia. The total semiconductor market was up 19.9% for this period. Excluding the memory companies, the remainder of the semiconductor market was up only 6.8%. If both the memory companies and Nvidia are excluded, the rest of the semiconductor market declined 10.5%

Several major semiconductor companies experienced revenue declines in 1Q 2024 through 3Q 2024 versus a year earlier. STMicroelectronics and Analog Devices were each down 24%. Texas Instruments, Infineon Technologies, NXP Semiconductors, and Renesas Electronics also declined. These companies largely depend on the automotive and industrial sectors, which have been weak in 2024. Companies heavily dependent on the smartphone market showed revenue increases, with Qualcomm’s IC business up 10% and MediaTek up 25%. Among computer dependent companies, Intel was flat, and AMD was up 10%. Broadcom counts on AI for a significant portion of its revenues. Its calendar 3Q results have not yet been released, but it should be up about 47%.

Thus, except for AI and memory, the semiconductor market has been weak in 2024. Our Semiconductor Intelligence forecast of 6% growth in the semiconductor market in 2025 assumes some strengthening of core markets of PCs, smartphones, automotive and industrial. The rapid growth rates of memory and AI in 2024 should be significantly lower in 2025.

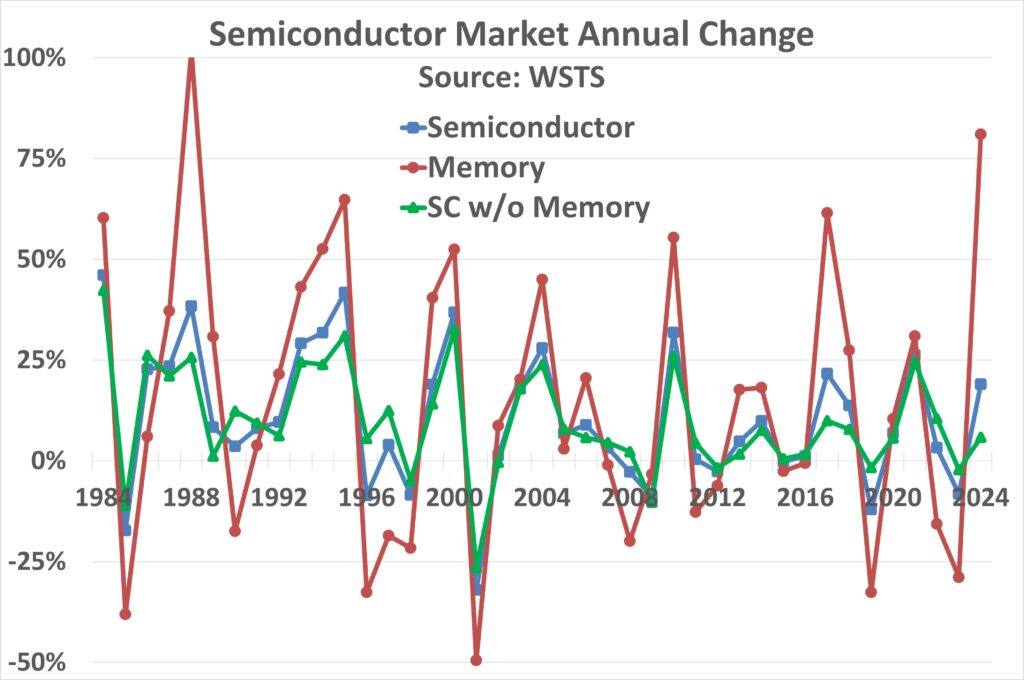

Memory has long exacerbated the cycles of the semiconductor industry. The chart below shows annual change in the semiconductor market based on WSTS data through 2023 and the WSTS forecast for 2024. Total semiconductor is compared with memory and semiconductor excluding memory. While the memory market has shown extremes of 102% growth and a 49% decline, the market excluding memory has been somewhat more stable, ranging from plus 42% to minus 26%. In the last ten years, the memory market change has ranged from plus 81% in 2024 to minus 33% in 2023 while the market excluding memory has ranged from plus 25% to minus 2%.

Over the last forty years, whenever the memory market has grown over 50%, it has seen a significant deceleration or a decline in the following year. In the six times this has occurred prior to 2024, the memory market has declined in the following year four times. In two cases the market has seen positive but significantly slower growth the following year and declines two years after the peak. These trends are driven by basic supply and demand for a commodity product. Memory prices and production rise when supply is below demand. When supply is above demand, production and prices fall. Thus, we should expect a significant downturn in the memory market either in 2025 or 2026.