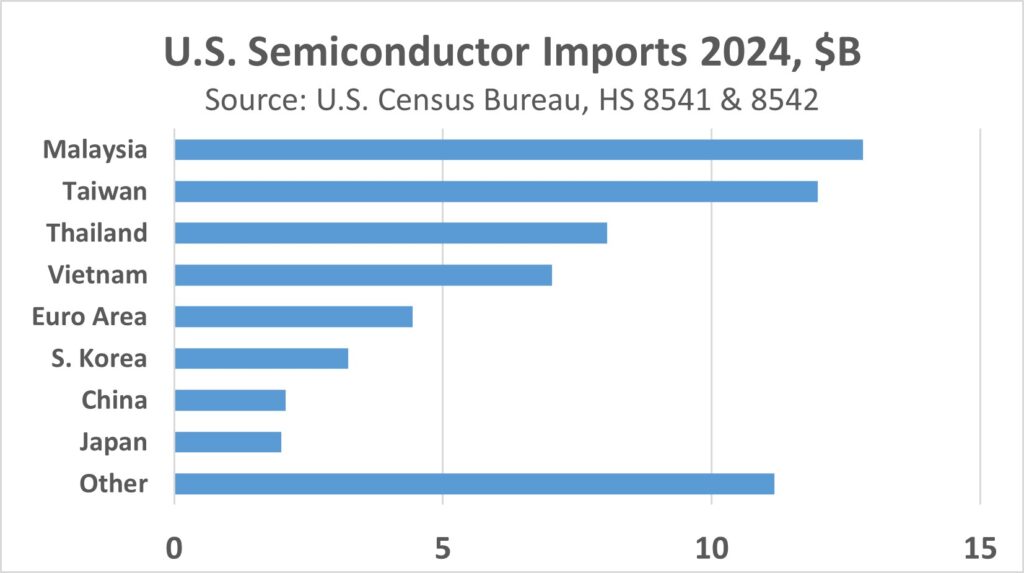

President Donald Trump has initially excluded semiconductors from his latest round of U.S. tariffs. However, he could put tariffs on semiconductors in the future. If tariffs are placed on semiconductors imported to the U.S., how would that affect U.S.-based semiconductor companies? The chart below shows U.S. semiconductor imports for the year 2024. 64% of imports are from just four countries: Malaysia, Taiwan, Thailand, and Vietnam. China accounts for only 3% of imports. Semiconductors made in China generally come into the U.S. as components in finished electronics equipment such as PCs and smartphones.

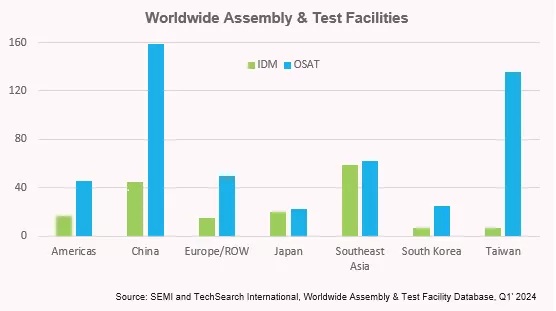

Why are these four countries such a significant portion of U.S. semiconductor imports? Except for Taiwan, they do not have significant wafer fabs. However, they account for a major portion of semiconductor assembly and test (A&T) facilities. These facilities take wafers from fabs, assemble them into packages, and test to see if they meet specifications. These A&T facilities may belong to the semiconductor manufacturer (IDM) or may be owned by outsourced assembly and test (OSAT) companies. The chart below from SEMI shows the distribution of these facilities. China, Taiwan and Southeast Asia account for 70% of A&T facilities.

The major U.S.-based IDMs all have most of their A&T facilities outside of the U.S. as show below:

Fabless U.S.-based companies such as Nvidia, Qualcomm, Broadcom and AMD primarily use TSMC’s foundry services. TSMC mainly uses its own A&T facilities located in Taiwan.

Thus, if tariffs are placed on semiconductor imports to the U.S., it would drive up costs for U.S.-based semiconductor companies. The U.S. companies with their own fabs have most of their fab capacity in the U.S., but have the vast majority of their A&T capacity outside of the U.S. TSMC is building fabs in the U.S., but currently has no A&T facilities in the U.S.

A solution to avoid tariffs would be for companies to build more A&T facilities in the U.S. However, it will take significant time and money to build these facilities. Below are proposed new A&T facilities announced in the last few years.

Based on these projects, it takes two to three years to build a new A&T facility. The cost could be over $4 billion. Only two of these new facilities are in the U.S. Amkor, an OSAT company, is building an A&T facility to support TSMC’s fabs in Arizona. Integra Technologies, an OSAT company, announced plans for an A&T facility in Kansas, but the project has been delayed. Intel’s A&T facility in Poland has been delayed at least two years.

Significant cost differences exist in building facilities in the U.S. and Europe versus Asia. The three A&T facilities planned for the U.S. and Europe have an average estimated cost of $3 billion and average employment of 1,900 people. The three facilities planned for Asia have an average cost of $840 million and average employment of 3,500 people.

Any tariffs placed on semiconductor imports to the U.S. would raise the costs to most U.S.-based semiconductor companies as well as foreign companies. If U.S. companies decide to build more A&T facilities in the U.S., it will take several years and drive-up A&T costs.