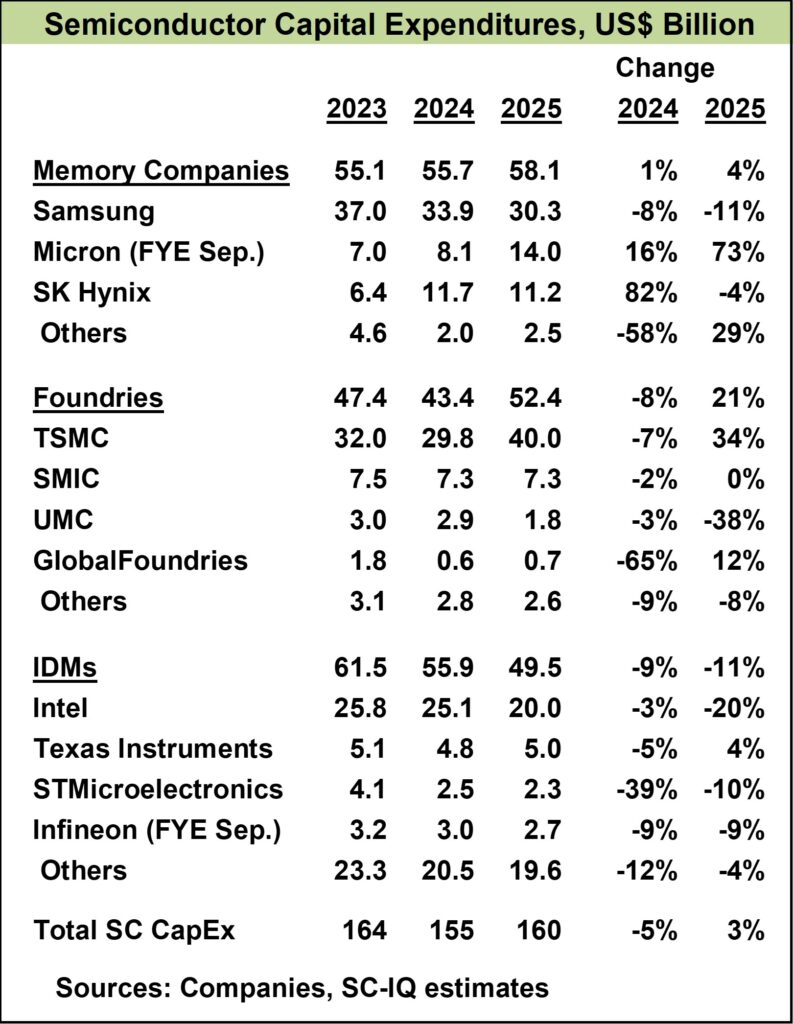

Semiconductor Intelligence (SC-IQ) estimates semiconductor capital expenditures (CapEx) in 2024 were $155 billion, down 5% from $164 billion in 2023. Our forecast for 2025 is $160 billion, up 3%. The increase in 2025 is primarily driven by two companies. TSMC, the largest foundry company, plans between $38 billion and $42 billion in 2025 CapEx. Using the midpoint, this is an increase of $10 billion or 34%. Micron Technology projects CapEx of $14 billion for its 2025 fiscal year ending in August, up $6 billon or 73% from the previous fiscal year. Excluding these two companies, 2025 total semiconductor CapEx would decrease $12 billion or 10% from 2024. Two of the three companies with the largest CapEx plan significant cuts in 2025 with Intel down 20% and Samsung down 11%.

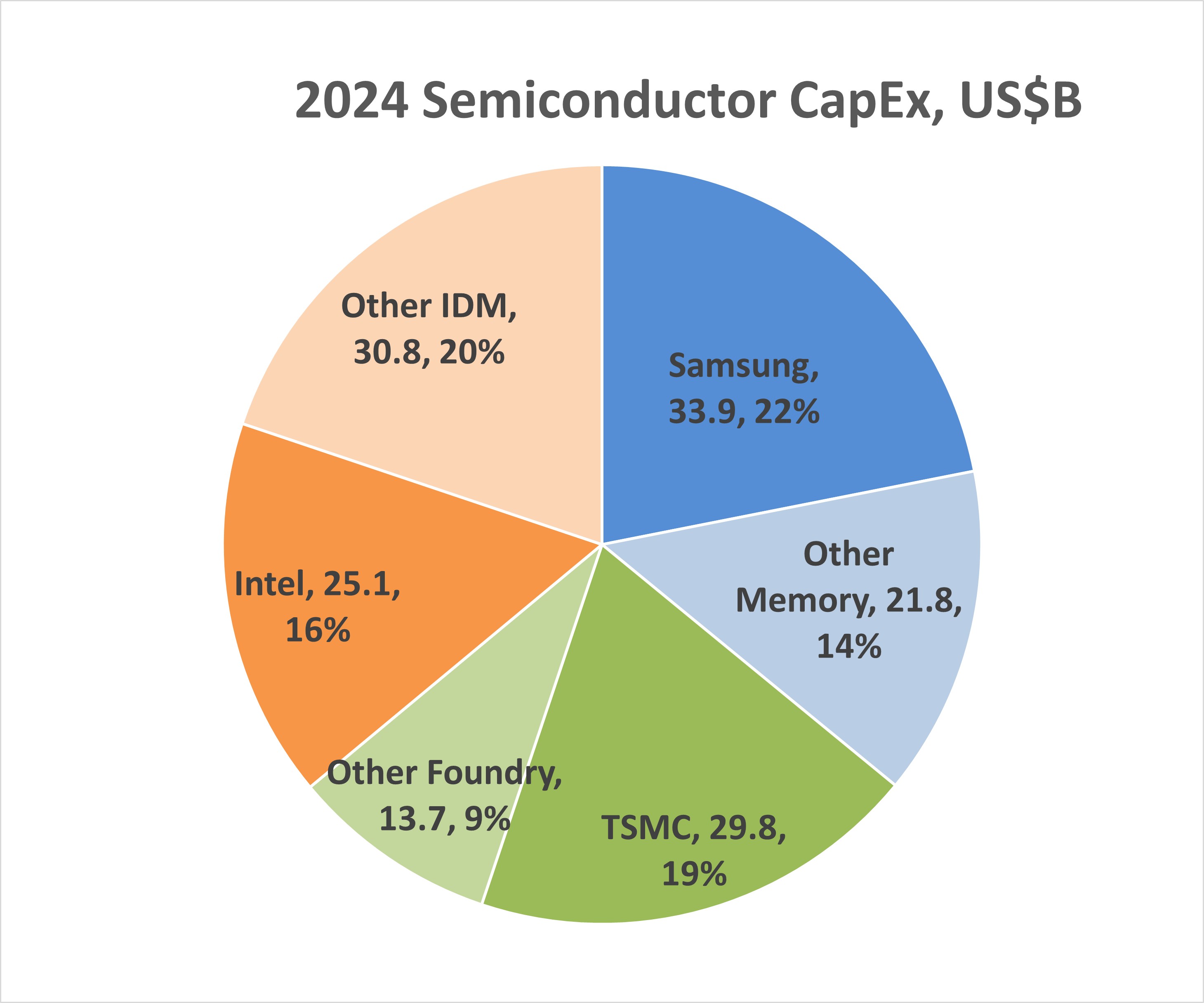

Semiconductor CapEx is dominated by three companies which accounted for 57% of the total in 2024: Samsung, TSMC, and Intel. As illustrated below, Samsung is responsible for 61% of total memory CapEx. TSMC spends 69% of foundry CapEx. Among Integrated Device Manufacturers (IDMs), Intel accounted for 45% of CapEx. The foundry CapEx total is based on pure-play foundries. Both Samsung and Intel also have CapEx for foundry services.

The U.S. CHIPS Act was designed to increase semiconductor manufacturing in the U.S. According to the Semiconductor Industry Association (SIA), the CHIPS Act has announced $32 billion in grants and $6 billion in loans to 32 companies for 48 projects. The largest CHIPS investments are:

| Company | Investment | Purpose | Locations |

| Intel | $7.8 billion | New/upgraded wafer fabs & packaging facility | Arizona, Ohio, New Mexico, Oregon |

| TSMC | $6.6 billion | New wafer fabs | Arizona |

| Micron Technology | $6.2 billion | New wafer fabs | Idaho, New York, Virginia |

| Samsung | $4.7 billion | New/upgraded wafer fabs | Texas |

| Texas Instruments | $1.6 billion | New wafer fabs | Texas, Utah |

| GlobalFoundries | $1.6 billion | New/upgraded wafer fabs | New York, Vermont |

Since the latest CHIPS funding, Intel announced last month it will delay the initial opening of its planned wafer fabs in Ohio from 2027 to 2030. The Ohio fabs account for $1.5 billion of Intel’s $7.8 billion CHIPS funding. TSMC, however, announced this month it will spend an additional $100 billion on wafer fabs in the U.S. on top of the $65 billion already announced. The Trump administration has voiced its opposition to the CHIPS Act and requested the U.S. Congress to end it. If the CHIPS Act is repealed, the fate of announced CHIPS investments is uncertain.

We at Semiconductor Intelligence believe the CHIPS Act did not necessarily increase overall semiconductor CapEx. Companies plan their wafer fabs based on current and expected demand. The CHIPS Act likely influenced the location of some wafer fabs. TSMC currently has five 300 mm wafer fabs, four in Taiwan and one in China. TSMC plans to build a total of six new fabs in the U.S. and one in Germany. Samsung already had a major wafer fab in Texas, so it is uncertain if the CHIPS Act influenced its decision to build new fabs in Texas. The major U.S.-based semiconductor manufacturers (Intel, Micron, and TI) generally locate their wafer fabs in the U.S. Intel has most of its fab capacity in the U.S. but also has 300 mm fabs in Israel and Ireland. Micron has built its wafer fabs in the U.S., but through company acquisitions has fabs in Taiwan, Singapore and Japan. Texas Instruments has built all its 300 mm fabs in the U.S.

Political pressures may also affect fab location decisions. The Trump administration is considering a 25% or higher tariff on semiconductor imports to the U.S. However, tariffs on U.S. imports of semiconductors will affect companies with U.S. wafer fabs. Most of the final assembly and test of semiconductors is done outside of the U.S. According to SEMI, less than 10% of worldwide assembly and test facilities are in the U.S. The U.S. imported $63 billion of semiconductors in 2024. $28 billion, or 44%, of these imports were from three countries which have no significant wafer fab capacity but are major locations of assembly and test facilities: Malaysia, Thailand and Vietnam. SEMI estimates China has about 25% of total assembly and test facilities but only accounted for $2 billion, or 3%, of U.S. semiconductor imports. The China number is low because most semiconductors made in China are used in electronic equipment made in China. Thus, tariffs on U.S. semiconductor imports would likely hurt U.S. based companies and other companies with U.S. wafer fabs more than they would hurt China.

The global outlook for the semiconductor industry in 2025 is uncertain. The U.S. has implemented several tariff increases on certain imports and it’s considering more. Other countries have either raised or are considering raising tariffs on goods imported from the U.S. in retaliation. The tariffs will increase prices for the final consumers and thus will likely decrease demand. The tariffs may not be placed directly on semiconductors but will have a major impact on the industry if applied to goods with high semiconductor content.