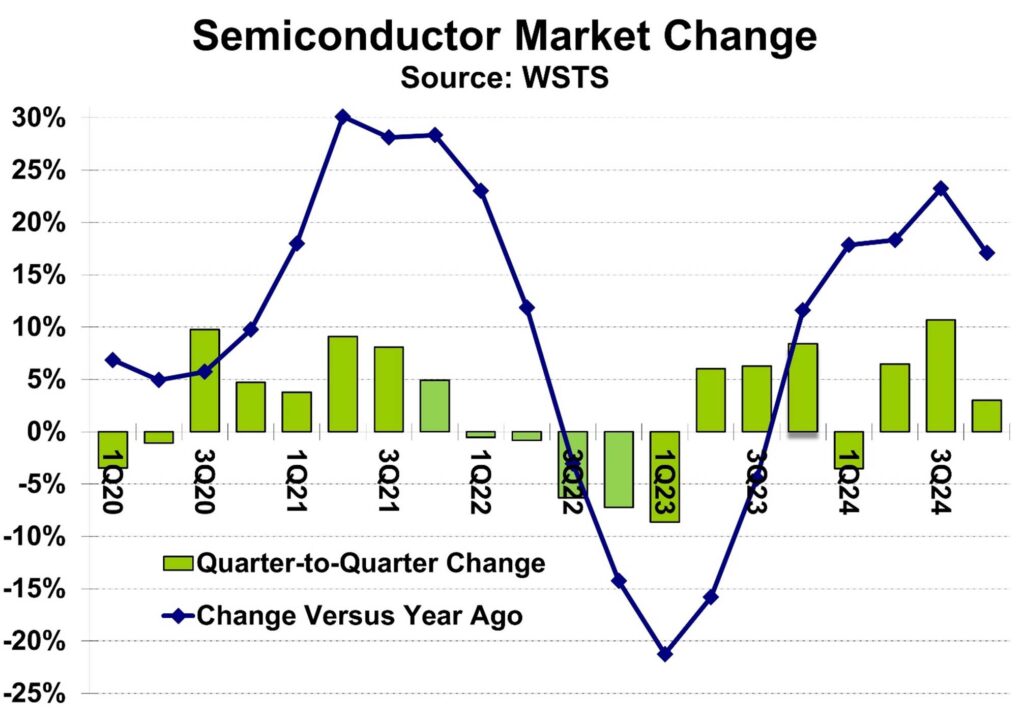

WSTS reported the global semiconductor market in 4th quarter 2024 was $170.9 billion, up 17% from a year earlier and up 3% from 3rd quarter 2024. The full year 2024 market was $628 billion, up 19.1% from 2023.

We at Semiconductor Intelligence give a virtual award for the most accurate semiconductor market forecast for the year. The criteria are publicly available forecasts released between October of the previous year and release of the WSTS January data in early March. For 2024 we have a tie. IDC in November 2023 projected growth of 20.2% in 2024. In February 2024, our Semiconductor Intelligence forecast was 18.0%. Thus, the final 2024 growth of 19.1% is halfway in between. Other forecasts made in this period ranged from 5% to 16%.

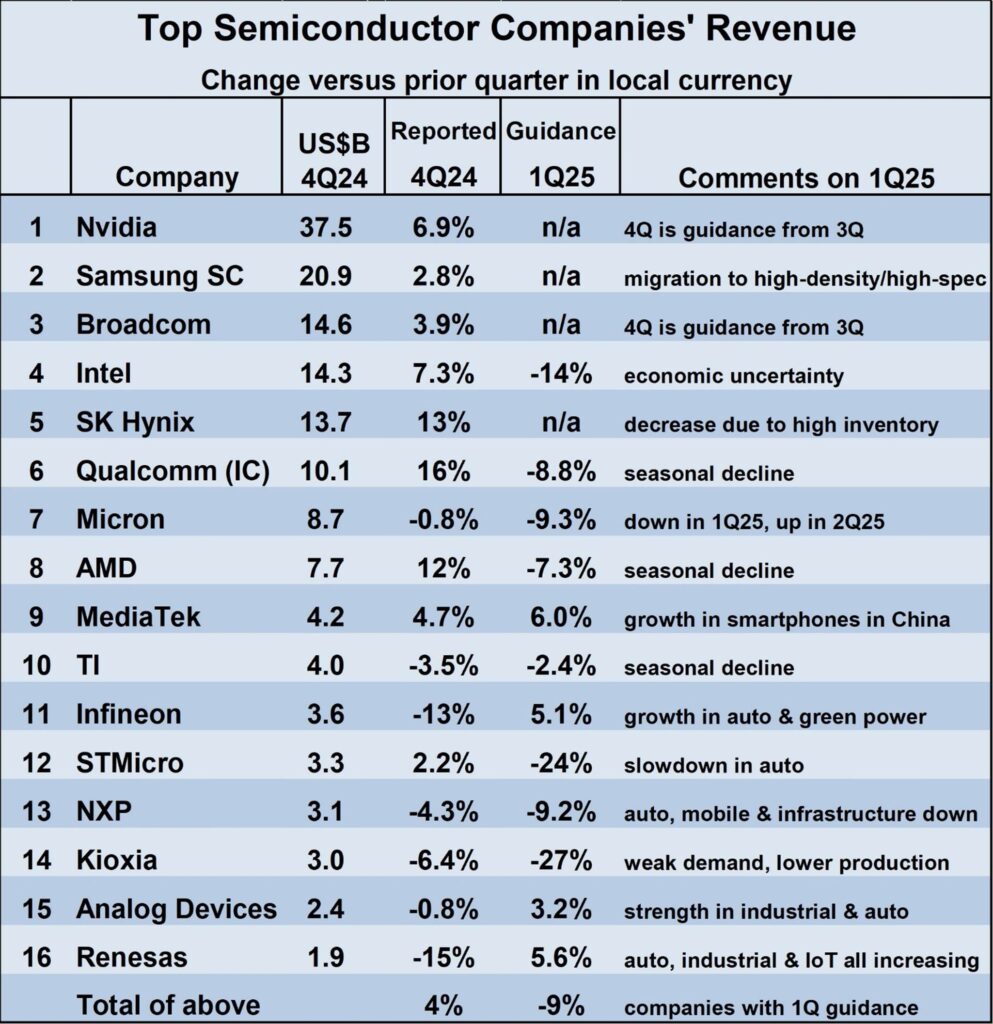

The 4Q 2024 revenue reports from sixteen major semiconductor companies varied widely. Nine companies reported increased revenues in 4Q 2024 versus 3Q 2024. Three companies – SK Hynix, Qualcomm and AMD – reported double-digit growth. Seven companies reported declines, with Infineon Technologies and Renesas Electronics reporting double-digit declines.

The companies providing guidance for 1Q 2025 revenue mostly expect declines from 4Q 2024. MediaTek, Infineon, Analog Devices, and Renesas expect low-to-mid single-digit growth. The other eight companies providing guidance expect declines, ranging from minus 2.4% for Texas Instruments to minus 27% for Kioxia. Factors cited for the declines included seasonality, excess inventories, weak demand, lower production and economic uncertainty. The weighted average revenue change for 1Q 2025 versus 4Q 2024 from the twelve companies providing guidance was a 9% decline. Over the last ten years, the semiconductor market has declined in the first quarter versus the fourth quarter nine times, ranging from minus 14.7% to minus 0.5%, averaging minus 5%. The only first quarter increase during this period was 3.8% growth in 1Q 2021 during the recovery from the 2020 pandemic. Thus, the 1Q 2025 revenue guidance appears worse than typical seasonality.

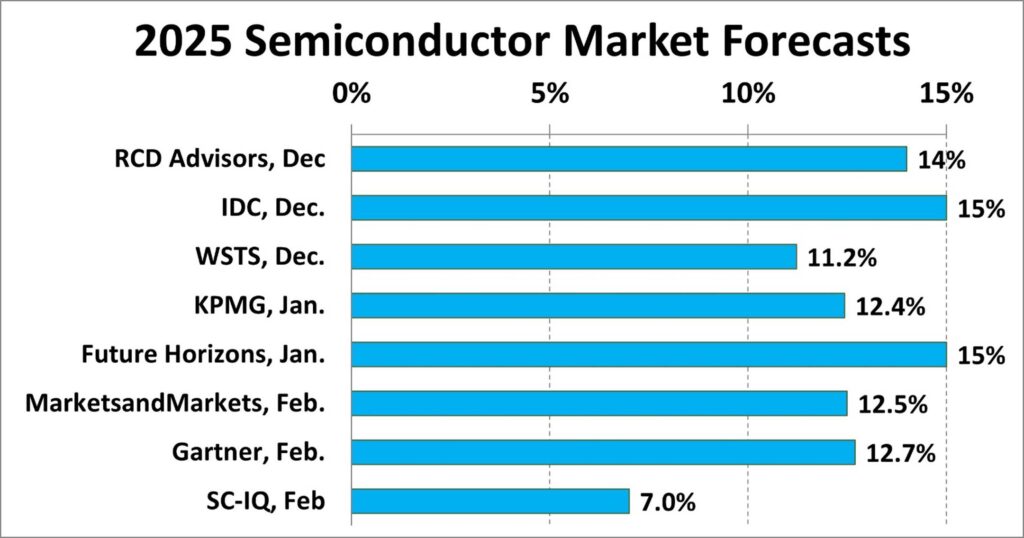

Given the expected slow start to the year, what is the outlook for the semiconductor market for the full year 2025? Forecasts released over the last three months range from our Semiconductor Intelligence’s 7.0% to 15% from IDC and Future Horizons. Our 7% forecast is an outlier, with other forecasts in the 11% to 15% range.

The factors driving our conservative outlook for 2025 are:

- AI servers drove most of the semiconductor market growth in 2024 as shown in our December 2024 newsletter. They should remain strong in 2025, but at a significantly lower growth rate.

- Key market drivers such as smartphones, PCs, automotive and industrial remain weak.

- The global economy is uncertain in 2025 with the U.S. threatening increased tariffs on imports and other countries promising retaliatory tariffs. Increasing tariffs will increase costs for consumers, potentially resulting in decreased demand and/or increased inflation.